Prediction markets continue to proliferate. These communities use money to bet on outcomes in the future. If a prediction comes true, the winners reap the money from the losing betters. The price of a bet, or share, fluctuates over time — and thus can be used as a signal for the community’s opinion. In theory a prediction market taps into the “wisdom of crowds,” but can also be viewed as conventional wisdom. However the results of prediction markets have been proven to be reliable conventional wisdom. (See my previous post on the subject.)

There are two kinds of prediction markets: ones where you bet real money, and ones where you bet funny money. Since betting real money keeps people honest (to reduce their loses), markets with real money are considered a much better indicator of opinion than a mere poll — which has no “penalty” for being less than honest. But real money prediction markets are (stupidly) illegal in the US. So token markets like Long Bets and Bet2Give are devised to innovate around the law.

For instance, Hubdub trades token dollars. You are given $1,000 hubdubs at the start, and $20 each day you log on. You win or loose these token dollars on various predictions. There is a leaderboard which displays the highest ranked traders, showing how much they have gained in the last quarter. One fellow gained $1 million hubdubs, and now has a net worth of $3 million. Hubdub dollars are only good for bragging rights.

One clarification of how the price of a bet works (from Hubdub’s FAQ):

If a prediction has a yes value of 43%, does that mean that 43% of people have voted yes?

No, not really. The forecast is dependent on both the number of people who have selected this outcome and the amount they have risked on it. Very roughly, 43% means that 43% of the money risked by users is riding on that outcome.

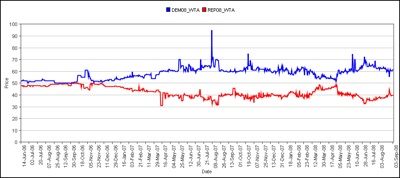

I was curious how closely the two formats (real and token money) might match each other so I hunted for a bet that I thought most prediction markets might share: the outcome of the US presidential election. From my brief survey, betting real dollars and token dollars give similar results. More so, there is a pretty close convergence of price among all the prediction markets:

Roughly, the day after Republican VP candidate Sarah Palin gave her rousing nomination speech, all six different prediction markets price Obama winning at about 60%.

Betfair, based in England, trades real money to make bets. It is the biggest prediction market in the world in terms of numbers of bettors and dollars bet. It’s bread and butter are sports events, including the Olympics, and card games, but it also runs bets on almost anything else including politics.

The day after VP candidate Sarah Palin’s nomination speach, Betfair bookies put the odds for Obama winning at 1.6 and give worse odds for McCain winning at 2.72.

Intrade also bets real money, also mostly on sports, but also on many other wagers. On this same day, Intrade money is on Obama winning at 59%.

On this same day Hubdub market rates on Obama win at 63%.

On this same day the Iowa Electronic Markets, which I’ve written about previously, and is the only prediction market in the US to legally use real dollars, has Obama winning at 59%.

On this same day, Bet2Give also pegs Obama winning at 63 cents or 63%.

Bet2Give is run on Newsfuture software and is sort of a non-profit demo for Newsfutures, which sells software for customized enterprise-strength prediction markets. They promise that a company can “harness the wisdom of your crowds.” In Bet2Give you bet with real dollars but your winnings are given to charities, so technically you are not gambling.

Newsfutures itself runs a prediction market using token dollars. On this same day it shows a 60% chance of an Obama win.

PPX is another token market. Run by Popular Science magazine, it is their Prediction Exchange. It does not do political predictions, so there’s no chart or price for a new US president. Instead it focuses on tech and commercial predictions. Such as: Will Netflix top 10 million subscribers by end of 2008? (You need to register to see the wagers).

My conclusion is that token money prediction markets carry the same validity as real money prediction markets, and that they are fairly consistent across markets. In that sense they are probably reliable indicators of what people believe at this moment (not be confused with reliable predictions).