From the preacher warning that the day of reckoning is nigh, to the sports analyst prognosticating about the outcome of next week’s big game, to the fortune teller calling for hard times in Mercury retrograde, predictions are pervasive, but accountability is rare. That the vast majority of predictions fail to come true is hardly a deterrent; we tend to remember the few that do.

This is a story about a prediction that was made ten years ago, on the eve of the worst financial crisis since the Great Depression, by Warren Buffett, one of the three richest people in the world. Unlike most predictions, Buffett’s came to pass. And unlike most predictors, Buffett was willing to put his money where his mouth was.

I. The Oracle of Omaha

In May 02006, some 20,000 investors convened, as they did every year, at the Berkshire Hathaway annual meeting to hear the Oracle of Omaha hold forth. After issuing prophecies on matters such as whether to invest in newspapers (don’t), and a looming housing bubble (there would be), Berkshire Hathaway CEO and legendary investor Warren Buffett took aim at hedge fund managers and the exorbitant fees they charged investors for their supposed expertise in beating the market.

“If your wife is going to have a baby,” Buffett said, “you’d be better to call an obstetrician than do it yourself. If your pipes leak, you should call a plumber. Most professions add value beyond what the average person can do for themselves. But in aggregate, the investment profession does not do this — despite $140 billion in total annual compensation.”

Every hedge fund manager believes they’ll be the exception that outperforms the market, Buffett said, even after taking into account the high fees they charge. Some certainly do. But over time, and in aggregate, the “math doesn’t work.”

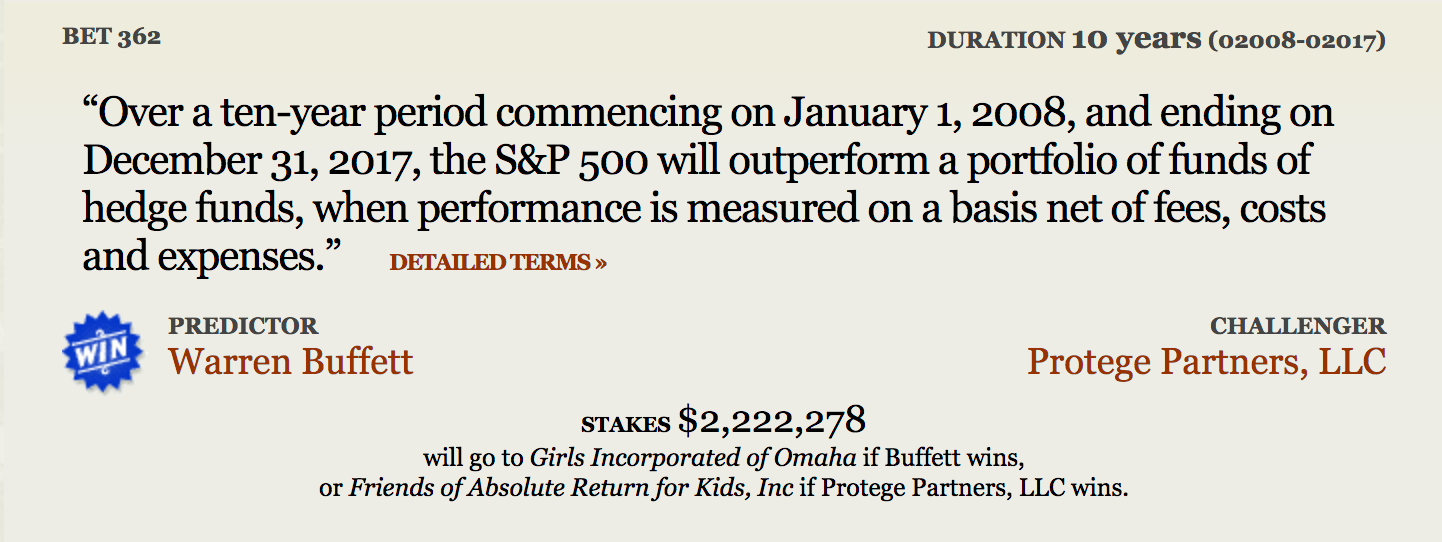

Buffett said he was willing to bet anyone $500,000 that over ten years, an S&P index fund would outperform a collection of hedge funds. An index fund, at low-risk and low-cost, neither underperforming nor overperforming the market, has been called the “most boring fund there is.” It simply follows the market’s undulations, for better or for worse. And, since it’s not actively managed, the fees are a fraction of something like a hedge fund. In Buffett’s eyes, that’s almost always a better investment than trusting the experts.

As he wrote in his 02017 Berkshire Hathaway annual report:

Over the years, I’ve often been asked for investment advice, and in the process of answering I’ve learned a good deal about human behavior. My regular recommendation has been a low-cost S&P 500 index fund. To their credit, my friends who possess only modest means have usually followed my suggestion.

I believe, however, that none of the mega-rich individuals, institutions or pension funds has followed that same advice when I’ve given it to them. Instead, these investors politely thank me for my thoughts and depart to listen to the siren song of a high-fee manager or, in the case of many institutions, to seek out another breed of hyper-helper called a consultant.

Buffett didn’t have any takers that weekend, nor in the months that followed. But in July 02007, Ted Seides, a principal at investment firm Protégé Partners, wrote Buffett to say he was in. “For hedge funds, success can mean outperforming the market in lean times, while underperforming in the best of times,” Seides later wrote in his official argument against Buffett’s bet. “Through a cycle, nevertheless, top hedge fund managers have surpassed market returns net of all fees, while assuming less risk as well. We believe such results will continue.”

Seides reasoned that Protégé would have an eighty-five percent chance of winning. And anyway, the bet would doubtless garner Protégé a lot of publicity.

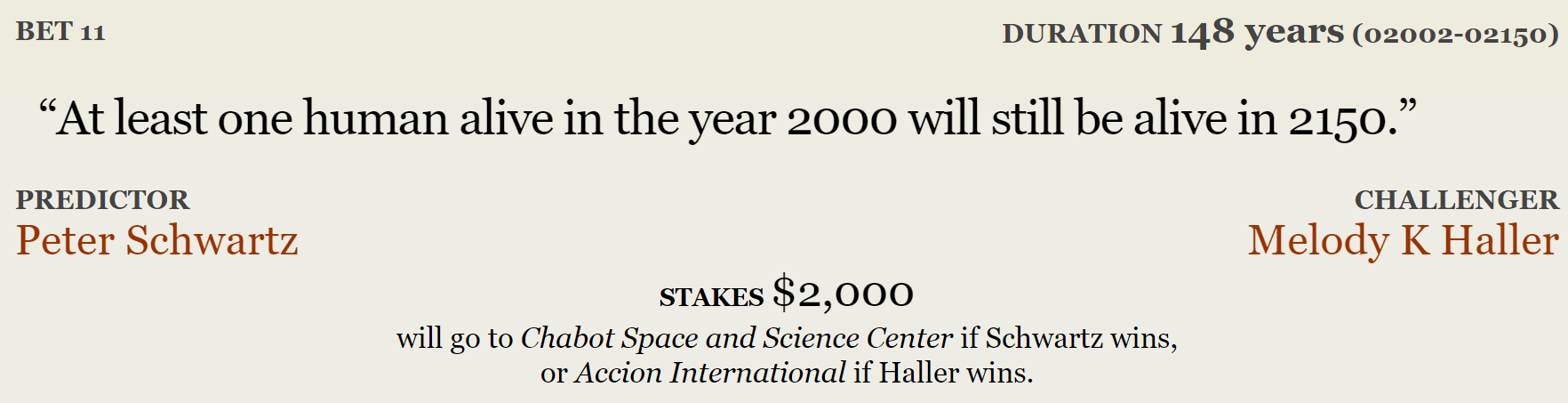

The question then became how to place the bet legally and publicly. Betting where bettors keep the money winnings is defined as gambling and is illegal throughout the United States. Though some may do it under the table, Buffett and Protégé wanted the bet to play out in the public, with their reputations on the line. For that, there was really only one game in town: Long Bets, The Long Now Foundation’s public arena for competitive predictions of interest to society. Each side picks a charity, and the winnings go to the winner’s charity choice. That was just fine with Buffett and Protégé. $1 million might make a substantial difference in most people’s lives, but it’s a different story when a man with a net worth in the tens of billions of dollars takes on a hedge fund. After all, this bet wasn’t about the money. It was about being right.

II. Wanna Bet?

The story of Long Bets begins, appropriately, with a bet. In 01995, Kevin Kelly, then-Executive Editor of Wired, was interviewing self-described neo-luddite Kirkpatrick Sale, who believed the end of the world was imminent. In the interview, Sale said that by 02020, humanity would suffer “multinational global currency collapse, social friction and warfare both between the rich and the poor and within nations, and […] continent-wide environmental disasters causing death and great migrations of people” — a perspective that, suffice it to say, Kelly did not share.

“Would you be willing to bet on your view?” Kelly asked.

Sale said he was. Kelly pulled out a check for $1,000. The exchange was left in the interview for Wired’s readers to see.

“The bet forced both of us to refine strongly held beliefs, and because our predictions were now public, our reputations were on the line,” Kelly later wrote. “This is what public wagers can do: sharpen logic, filter out the halfhearted. Sometimes they can even alter collective views and shape society.”

As Kelly notes, there’s a long history of these kinds of public wagers, particularly in science. In 01600, astronomer Johannes Kepler bet his rival Christian Longomontanus that he could derive the formula for the solar orbit of Mars in eight days. It took him five years. Kepler lost the bet, but his calculations ultimately helped bring about modern astronomy. In 01870, flat earther John Hampden made a 500 pound bet with naturalist Alfred Russel Wallace (who, it should be noted, conceived of the theory of evolution independently of Darwin) that he could prove the Earth was flat using the Bedford Level Experiment. Hampden lost the bet, insisted that Wallace cheated, and ultimately was imprisoned for threatening to kill Wallace. The myth of the flat earth was laid to rest, albeit temporarily.

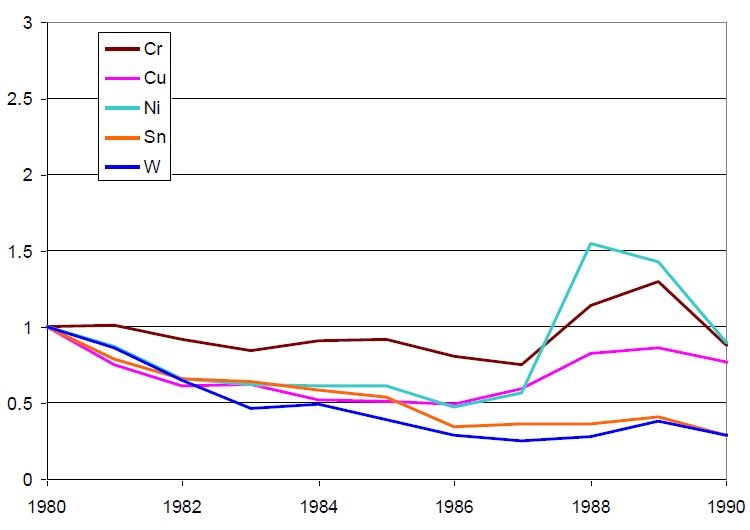

More recently, there’s the bet that biologist and environmentalist Paul Ehrlich made with economist Julian Simon in 01980. Simon bet Ehrlich $10,000 that the prices of five metals (copper, chromium, nickel, tin, and tungsten) would decrease over a decade. The prices declined sharply, and Simon won the bet.

The wager received a lot of publicity over the decade, and the result ultimately shaped societal thinking around limited resources. “Simon was a prolific skeptic of environmentalism,” Kelly wrote, “yet nothing that he ever wrote had as much impact on the course of culture as his wager with Ehrlich. That single, relatively small bet transformed the environmental movement by casting doubt on the notion of resource scarcity.” (Although, if the bet were repeated in subsequent decades, Ehrlich would have won, given the rise in commodity prices. On a long enough timescale, however, it’s one more blip in a multiple-centuries-long trend towards decreasing prices).

Both Kelly and Long Now Foundation co-founder Stewart Brand were intrigued by the Simon-Ehrlich bet and the public accountability and long-term thinking it made possible. (Ehrlich was Brand’s teacher and mentor at Stanford, and his concerns around resource scarcity and overpopulation were ones Brand used to share). Brand formulated the idea that would become Long Bets in an email to the Long Now board in May 02001:

People bet people about things that will happen farther in the future than the horserace next weekend. Peter Schwartz almost bet Hunter Lovins today about when electric-drive autos will be the norm — -in 10–20 years or in 15–25 years.

If Long Now offered a Longbets holding service, they could have bet, say $1,000, with the outcome to be decided in 02016. The money, the bet, and a fee could be placed with Long Now. The money draws interest in behalf of the eventual winner, minus a maintenance fee to Long Now. Long Now robots keep track of Peter and Hunter. As 2016 approaches the file wakes up and contacts them to begin negotiation toward resolution of the bet. If they don’t resolve, the amount is split 50–50. If they resolve, winner takes all. If only one of the two can be found, that person gets the winnings by default. If neither can be found, the money is held a while longer and then is absorbed into Long Now.

I bet it will work.

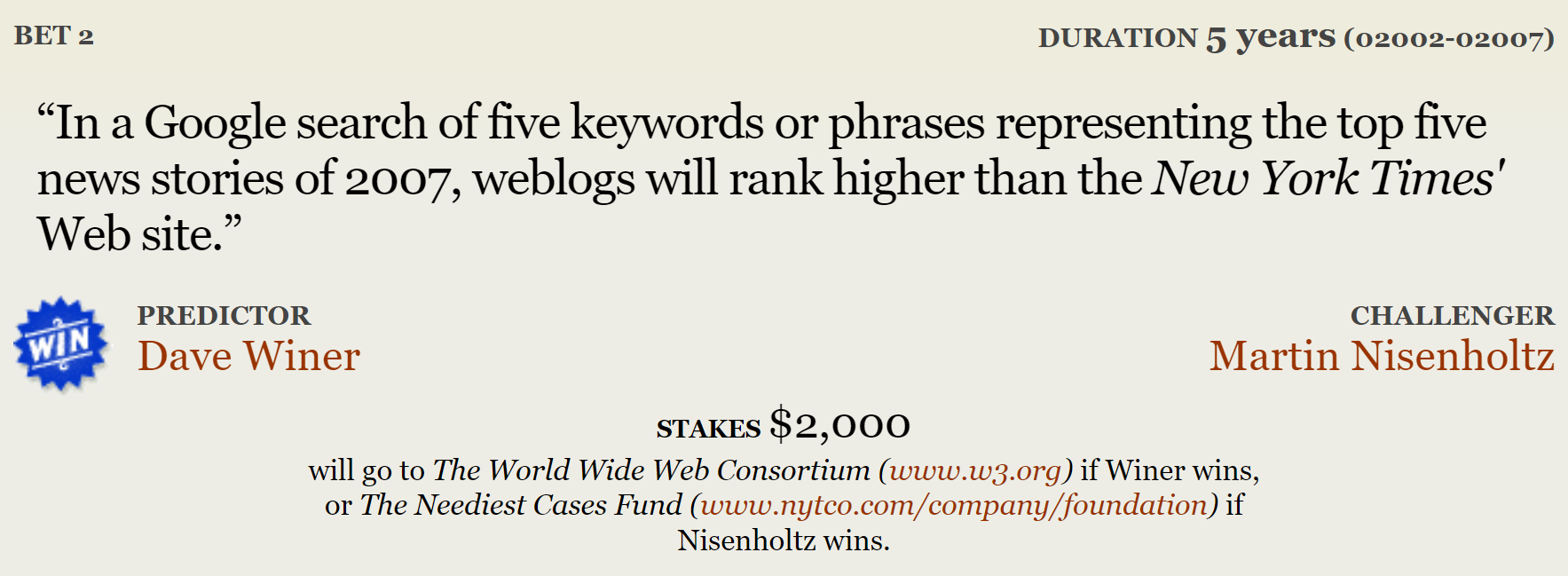

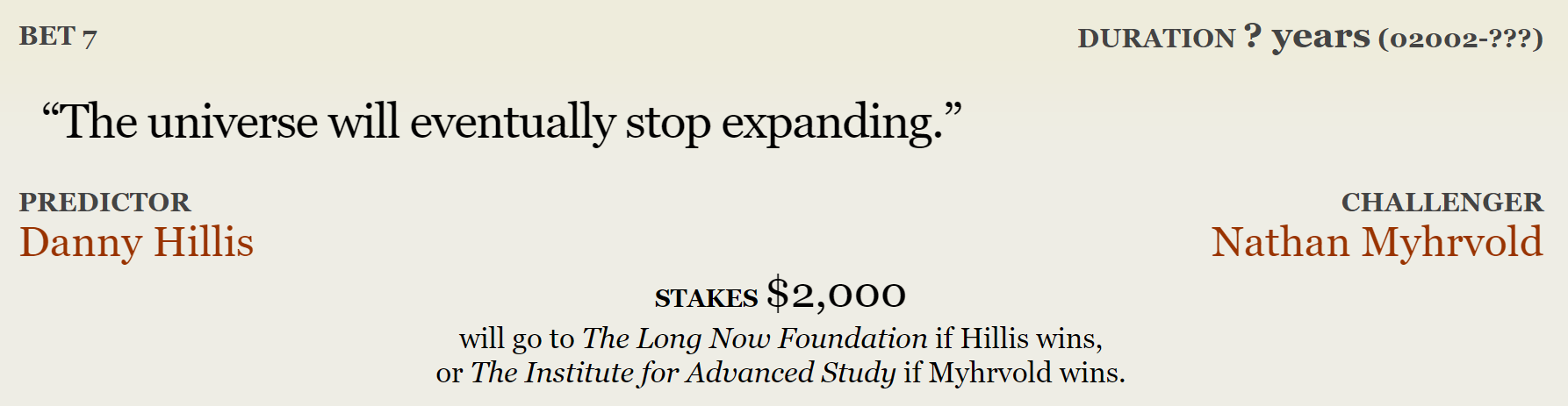

It did. Brand founded Long Bets in 02002 with Kevin Kelly and a little seeding assistance from Amazon’s Jeff Bezos. The forum asks all predictors to put their name, a solid argument, and a financial pledge down in support of their statement about the future. Long Now, in turn, provides a long-term record where any prediction can be revisited, reviewed, and discussed at any time.

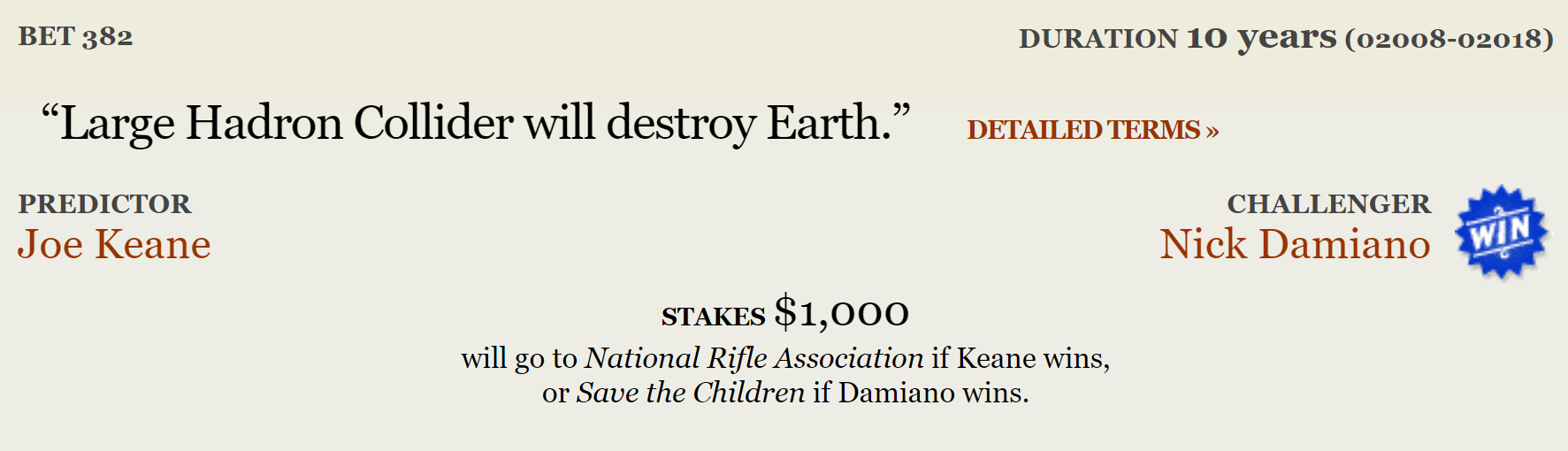

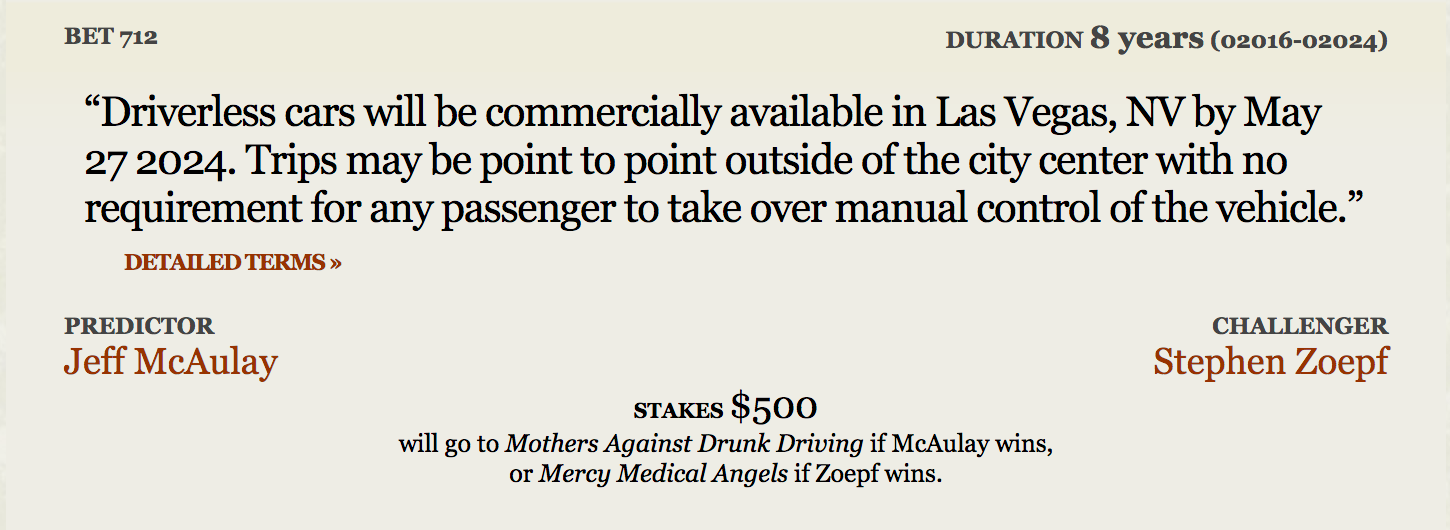

A Long Bet always starts with a prediction. All predictions should come with an argument in support, a financial pledge, and an end-date. The minimum term for a prediction is two years; there is no maximum term.

A prediction becomes a bet when a challenger comes forward with a counterargument. The predictor may then choose to make a bet with the challenger. The predictor and challenger will agree on a wager, and each will choose a charitable cause to receive the winnings.

When the end-date for the bet passes, The Long Now Foundation adjudicates the bet and donates the proceeds to the winner’s charity of choice.

The Long Bets site offers a public record of all predictions and bets. It highly encourages discussion about what we may learn, or what we have learned, from bets and their outcomes. This discussion feeds improvement of long-term thinking — the real pay-off.

The bets on Long Bets range from the serious, inculcating questions about what it means to be human, to the playful. The first Long Bet on record was between Mitchell Kapor, co-founder of The Electronic Frontier Foundation, and the futurist Ray Kurzweil, who popularized the idea of the technological singularity. Kapor bet Kurzweil $10,000 that by 02029, no computer — or “machine intelligence” — will have passed the Turing test (the test conceived in 01950 by mathematician Alan Turing that tests whether a machine is capable of human intelligence).

The first winner of a Long Bet was actor and Red Sox fanatic Ted Danson. In 02002, the late Time Editor Michael Elliott bet Danson $1,000 that the U.S. Men’s soccer team would win the World Cup before the Red Sox win the World Series. “The Red Sox have had such bad luck in the 20th century,” Danson argued, “I have to believe that in the new millennium it can only get better.” Danson would be vindicated a mere two years later.

The stakes of Long Bets typically ranged in the hundreds and thousands of dollars. Through 02007, the largest bet was the Kurzweil-Kapor Turing test bet. Then along came Warren Buffett.

III. The Tortoise and the Hare

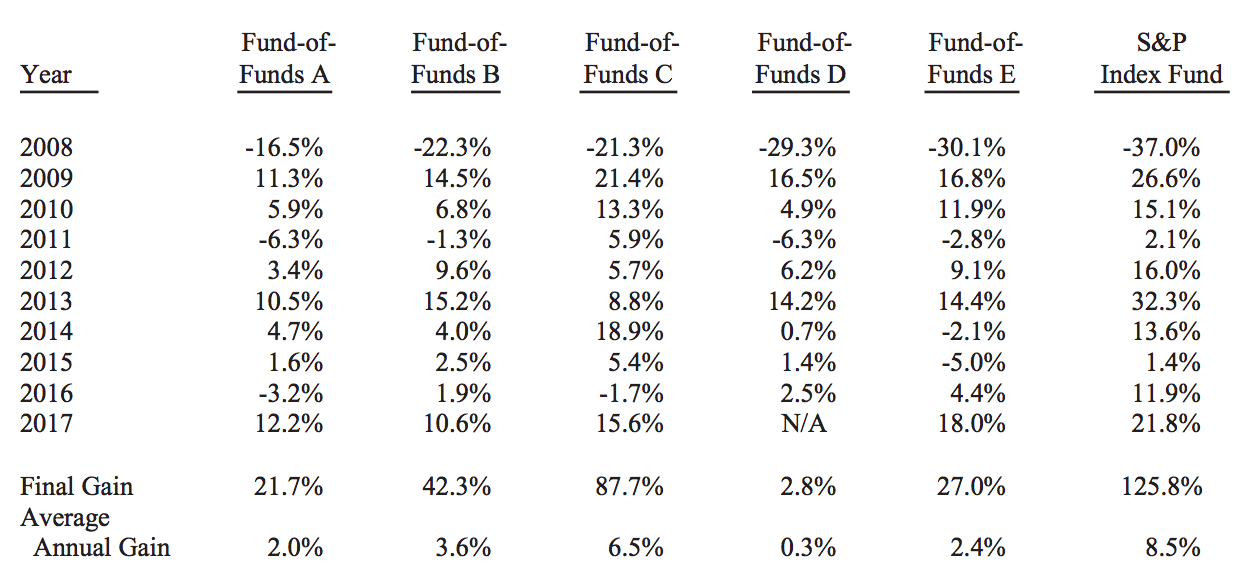

Buffett invested in the Vanguard index fund. Protégé picked five hedge funds of funds (whose names have never been publicly disclosed — although Buffett does see their annual audits).

Buffett and Protégé initially wagered an investment of $320,000 each that was expected become $1 million at the end of the bet. Seides chose the charity Absolute Return for Kids, a London-based philanthropic organization. Buffett chose Girls, Inc. from his hometown of Omaha.

“Buffett’s bet is an ideal Long Bet,” Kevin Kelly wrote once the bet was announced. “It makes a huge difference to anyone who invests in stocks (as do a large percentage of the US, either directly or indirectly) whether a boring index fund yields as much as fancy private hedge funds. The answer either way would be a huge influential signal.”

Carol Loomis, a friend of Buffett’s and reporter for Fortune, wrote at the time that, despite Seides’ confidence that Protégé would win easily, the hedge fund fees Buffett railed against were a significant hurdle. Further, because Protégé chose funds of funds, there was a second level of fees that would be imposed:

On top of the management fee, the hedge funds typically collect 20% of any gains they make. That leaves 80% for the investors. The fund of funds takes 5% (or more) of that 80% as its share of the gains. The upshot is that only 76% (at most) of the annual return made on an investor’s money accrues to him, with the rest going to the “helpers” that Buffett has written about. Meanwhile, the investor is paying his inexorable management fee of 2.5% on capital. The summation is pretty obvious. For Protégé to win this bet, the five funds of funds it has picked must do much, much better than the S&P.

Once the bet was officially announced, the webpage was flooded with comments and vigorous debate. “Voting Against Buffet? [sic],” Louise Murphy commented. “Am quite a novice when it comes to hedge funds and such, but I would never vote against one Warren Buffett. Time will tell.” It was a sentiment many shared.

“Fortunately for us, we’re betting against the S&P’s performance,” Seides said at the time. “Not Buffett’s.”

In the initial going, the S&P performed horribly. The global financial crisis intensified by November 02008, leaving the S&P down 45% from its 02007 high. After the first year, Protégé fund of funds trounced Buffett’s index fund. But all things considered, it was a bad year for both, with Buffett down 37% and Protégé down 23.9%. Buffett maintained his sense of humor.

“I just hope that Aesop was right,” he said, “when he envisioned the tortoise overtaking the hare.”

He was. Buffett steadily gained ground in the years that followed, finally overtaking Protégé in the bet’s fifth year. And he never looked back. By 02017, it was clear that, short of another collapse in the stock market, Buffett would prevail.

Over the decade-long bet, the index fund returned 7.1% compounded annually. Protégé funds returned an average of only 2.2% net of all fees. Buffett had made his point. When looking at returns, fees are often ignored or obscured. And when that money is not re-invested each year with the principal, it can almost never overtake an index fund if you take the long view.

“In my opinion, the disappointing results for hedge-fund investors that this bet exposed are almost certain to recur in the future,” Buffett said in last year’s Berkshire Hathaway annual report. “When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients. Both large and small investors should stick with low-cost index funds.”

Seides, meanwhile, thinks Buffett just got lucky, and that the S&P’s performance over the previous decade “vastly overperformed” his expectations. “My guess is that doubling down on a bet with Warren Buffett for the next 10 years would hold greater-than-even odds of victory,” he wrote in his 02017 concession essay.

Perhaps. Buffett, as you might expect, feels otherwise.

“Human behavior won’t change,” he said. “Wealthy individuals, pension funds, endowments and the like will continue to feel they deserve something ‘extra’ in investment advice. Those advisors who cleverly play to this expectation will get very rich. This year the magic potion may be hedge funds, next year something else. The likely result from this parade of promises is predicted in an adage: ‘When a person with money meets a person with experience, the one with experience ends up with the money and the one with money leaves with experience.’”

And what of the winnings? As it happens, the bond value of the initial wager appreciated faster than expected, resulting in shifting the investment strategy and growing the winnings to $2.2 million.

It’s a huge win for long-term thinking. But it’s an even bigger win for Girls Inc. of Omaha, which has an annual operating budget of $2.8 million. Protégé, Buffett and Long Now’s Executive Director Alexander Rose settled the bet on Friday, February 16, 02018 at Girls Inc. headquarters.

“I just told [Executive Director Roberta Wilhelm] to use it where it’s going to do the most good,” said Buffett.

The sum will be used to help renovate an old convent into a transitional home for girls as they age out of foster care. It will be called the Protégé House.

Learn More

- Do you have strong opinions about the future? Put your money where your mouth is. Make a bet with Long Bets here.

- Listen to Planet Money’s primer on the Bet.

- Read Wired’s 02002 Long Bets profile.

- Read Long Now’s year-by-year accounting of the bet.

- Read Warren Buffett’s 02018 Annual Report, where he shares his lessons from the bet.